Find More Tips on Saving For College in the Parent Handbook

Parents of sixth- through 12th-grade students use ISL Education Lending’s Parent Handbook to prepare their students for success after high school, whether for college or to pursue other postsecondary options.

Why It Matters

- Find more tips.

Take the time to explore the Parent Handbook for tips on academic success, exploring careers and education, selecting and applying to programs, and paying for college or other education. - It’s time to evaluate your savings plan.

As your student considers options for education and training after high school, this is a good opportunity to look at your progress saving for those costs. It may be time to adjust investment choices for a one- to four-year timeframe.

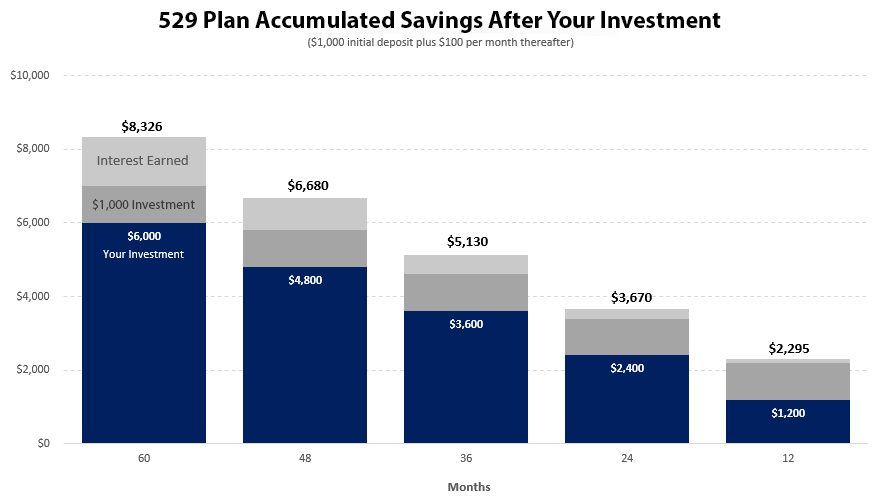

How a 529 Savings Account Boosts Your Savings

- This chart shows how creating an account with a $1,000 deposit and investing an additional $100 each month afterward grows at a 6.00% interest rate. (Estimated interest only; past performance of any investment choice does not indicate future returns.) The sooner you start, the more months your investment can grow before you need to pay educational costs.

- Don’t write off the potential for growth because your student is a high school junior. Your student may earn some scholarships that help offset costs the first year after high school but need additional funds when those expire. Carefully consider a year-by-year plan for paying the costs of a complete education or training program.

What Else You Can Do

- Learn more about 529 college savings plans.

ISave 529, formerly College Savings Iowa, is the state-sponsored 529 plan for Iowa residents that lets you save for education expenses and provides certain tax benefits. Visit www.ISave529.com to learn more about how 529 plans work and how to get started. Don’t live in Iowa? You can open a 529 plan from any state. Check here for a list of states with 529 plans. - Understand education costs.

Work with your student to understand potential costs for the training or education required for possible career paths. Then compare those costs to your student’s and family’s anticipated ability to pay for them. If a significant shortfall is likely, consider ways to increase earnings or reduce expenses to set aside more each month. - Register for the ISL Education Lending Scholarship.

Registration is open now for Iowa high school students and undergraduate college students, as well as their parents, on our website. The scholarship awards $1,000 ISave 529 deposits, which can be used when your student is ready to pay educational expenses.

Next Steps

Be sure to complete the survey questions at the end of this article to be entered into the 529 deposit giveaway!

Additional references, handouts and talking points are available in the right sidebar to use at your leisure. They may prove beneficial to reference now or after receiving future emails – we’ll leave it completely up to you. Use our emails like a recipe for a successful outcome — assemble the recommended ingredients and then follow accompanying directions to add flavor and depth.